While there have been a series of volatility-inducing events in the U.S. starting from the Fed’s ‘Taper Talk’ and then […]

Category: ETF Education

10 financial education mistakes young people do

For a long time I wanted to write this article and I hardly refrained myself from doing it. I hear […]

ETF investing dividend stocks

Dear fellow readers, Last week I have been to a masterclass about ETF’s and how it could balance your portfolio. […]

Uranium ETF for Energy investing

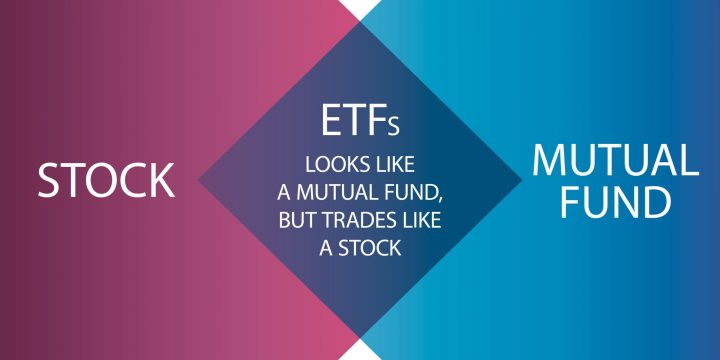

The ETF or exchange traded fund is a financial vehicle that provides a way for investors who do not participate […]

Why ETF Investing Has Become so Popular

After its start in 1993, ETFs have enjoyed steady popularity on the stock exchange. Furthermore, they have continued to acquire […]

A Comprehensive Guide to ETFs

ETFs or exchange-traded funds are one of the most valuable securities on the stock market. Bought or sold through a […]

What are Candlestick Charts?

Candlestick Charts are also well known by the name Japanese Candlestick Charts. This type of chart is used to represent […]